Home ownership is still hard to achieve.

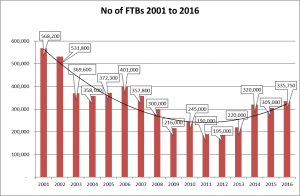

Research by Halifax says there were more first-time home buyers in 2016 than at any time since the start of the financial crisis, however that is well down on the numbers who were able to buy homes before 2007.

Joint Equity tracks first time buyer numbers because it is one of our primary sectors, the others are divorced and separated and retired renters, and we think the best way to understand what has happened to the market is to look at it graphically.

This graph shows the quite dramatic decline from the 2001 high but this does not tell the real story and that is the number of people, which grows each year, that are unable to live in their own home.

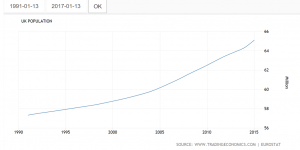

The average FTBs buying their own home from 1991 to 2000 was 507,233 every year. As our population grows from 57.5M in 1991 to 65M in 2015 it is reasonable to assume the real number of First Time Buyers wanting to live in their own home almost rises.

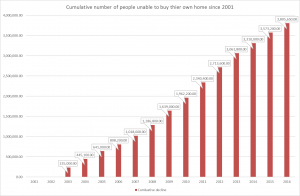

Now we are not statisticians (fortunately) and we accept that there are many factors that could distort our assumptions but we are simple people here at Joint Equity and we

look at things simply as probably this tells us the clearest story.

If the numbers of FTB’s in the early 1990’s was an average of 0.882% of the total population then if we assume the average number who want their own home is constant the number of FTBs in 2015 who want their own is 0.882% of 65M which is 573,390.

That means that in 2015 approximately 237,640 people wanted to buy their own home who could not, who were denied access to the home ownership market.

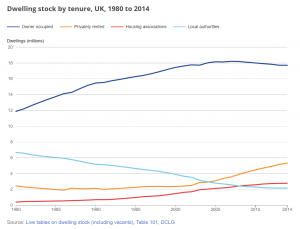

So where did they go as they must live somewhere after all? As we see from the media many go back home to Mum and Dad and the rest have to go into private or social rented. This is supported by the growth in the private rented sector over the last 20 years.

Extrapolating the fairly steady growth from 2005 to 2014 for 2015 and 2016 we now have 5,800,000 privately rented homes in England an increase of 2,700,000 since 2005.

So it’s a fair assumption that the decrease in owner occupation and increase in population has been accommodated in the private rental sector and that means the Buy to Let predominantly.

Returning to the decline in Fist Time Buyers we can assess the total number of people who would like to buy their own home and cannot as the difference between the average demand (570,000) and the take up of FTB homes in 2016 (335,750) which is 234,250 people who cannot buy their own home. If we do this for each year of the decline below the average demand, then we see 3,800,000 people have been unable to buy their own home since 2001. Which corresponds to the growth in Buy to Let.

Halifax also found the average first-time deposit more than doubled compared with 2007 to stand at more than £32,000 and 60% of first first-time buyers’ mortgages were for 25 years or longer, up from 36% a decade ago.

Other reports in 2016 have found the average age that people buy their own home is also rising and is now around 33.

With the constant attacks on Buy to Let landlords (see Another Blow to Buy to Let Investments here) the numbers of BtL properties available will be static (best case) or decline as the combination of increased stamp duty, lower tax allowances and higher mortgage criteria send investors elsewhere.

What we need is

- Another way for investors to participate in the UK residential property market that is simple, secure and pays reasonable returns.

- A financially viable alternative way for the people who want to live in their own home top do so.

Joint Equity shared home ownership scheme offers a solution to both home owners and investors.

Through Joint Equity Bonds investors can invest securely in UK residential assets at reasonable returns with attractive terminal bonuses.

The Joint Equity scheme offers a new alternative for aspiring home owners who cannot buy their own home because their income is too low or their deposit is too small to provide a reasonable mortgage for the home they want.

More information on Joint Equity www.jointequity.co.uk

ister David Cameron described the move as a “huge shift”, claiming it marks the biggest use of such a policy since Margaret Thatcher and Michael Heseltine started the regeneration of London’s Docklands in the Eighties.

ister David Cameron described the move as a “huge shift”, claiming it marks the biggest use of such a policy since Margaret Thatcher and Michael Heseltine started the regeneration of London’s Docklands in the Eighties.